2.42 - Your Job X AI

“The hero and the coward both feel the same thing, but the hero uses his fear, projects it onto his opponent, while the coward runs." - Cus D'Amato

News and Numbers

Markets this Week:

S&P 500 is down 2.4%.

NASDAQ 100 is down 3%.

Bitcoin-USD is down 6%.

Ethereum-USD is down 4%.

Headlines from this Week:

Google responds to the Canadian government’s online bill C-18 by rolling out tests that block access to news content for some Canadian users.

Chinese contract manufacturer (Luxshare) will develop the Apple’s augmented reality (AR) device.

Coinbase swings to quarterly loss as crypto winter hits trading volume.

Finance

By Vlad

Why AI Can’t Take Your Job

(If You’re Better Than It)

The advent of artificial intelligence (AI) has revolutionized the way we live and work. From self-driving cars to medical diagnosis, AI has transformed various industries and made many tasks more efficient. However, one area where AI has not been able to completely replace human intelligence is asset trading. Despite the hype around AI's predictive abilities, traders have not been replaced by AI, as they remain more effective at predicting markets than machines.

The idea that AI would take over asset trading gained traction in the early 2010s, when machine learning algorithms were first applied to the financial industry. The idea was that computers would be better at processing large amounts of data and identifying patterns than human traders. In theory, this would lead to better predictions and more profitable trades. However, as it turned out, AI was not able to perform better than human traders in practice.

One reason for this is that financial markets are complex and unpredictable. While AI algorithms can process vast amounts of data and identify patterns, they cannot account for the many variables that affect market behaviour. For example, sudden changes in global politics, unexpected natural disasters, and changes in consumer behaviour can all impact the market in ways that are difficult to predict. Traders, on the other hand, are able to use their experience and intuition to make informed decisions based on a range of factors.

Another factor that makes traders more effective than AI is the role of emotions in trading. While emotions can be a hindrance to rational decision-making, they can also be an asset in trading. Experienced traders are able to use their intuition and gut instincts to make decisions in the face of uncertainty. AI, on the other hand, lacks emotional intelligence and is unable to make intuitive decisions.

In addition to these factors, there is also the issue of data bias. AI algorithms are only as good as the data they are trained on. If the data is biased, the algorithm will also be biased. This is a significant problem in the financial industry, where historical data is often biased toward certain market conditions. Traders, on the other hand, are able to use their experience and intuition to recognize and adjust for bias in the data.

Despite these limitations, AI has still had a significant impact on the financial industry. AI algorithms automate many routine tasks, such as risk assessment and fraud detection. This has freed up traders to focus on more strategic tasks, such as developing trading strategies and managing client relationships. In this way, AI has been a complement to, rather than a replacement for, human intelligence in the financial industry.

In conclusion, while AI has transformed many industries, it has not been able to replace human intelligence in asset trading. Traders remain more effective at predicting markets than machines, due to the complexity of financial markets, the role of emotions in trading, and the issue of data bias. While AI has had a significant impact on the financial industry, it has not been the game-changer that some predicted it would be. Instead, AI has complemented human intelligence, allowing traders to focus on more strategic tasks and adding value to the industry as a whole.

This is not financial advice and you should always do your own research before investing in any securities or cryptocurrencies. The trading strategies mentioned above are only my opinion. I am not a public equities analyst, and you're following these tips at your own risk.

Sci-Tech

By Keyann Al-Kheder, Software Engineer

Choosing Crypto projects

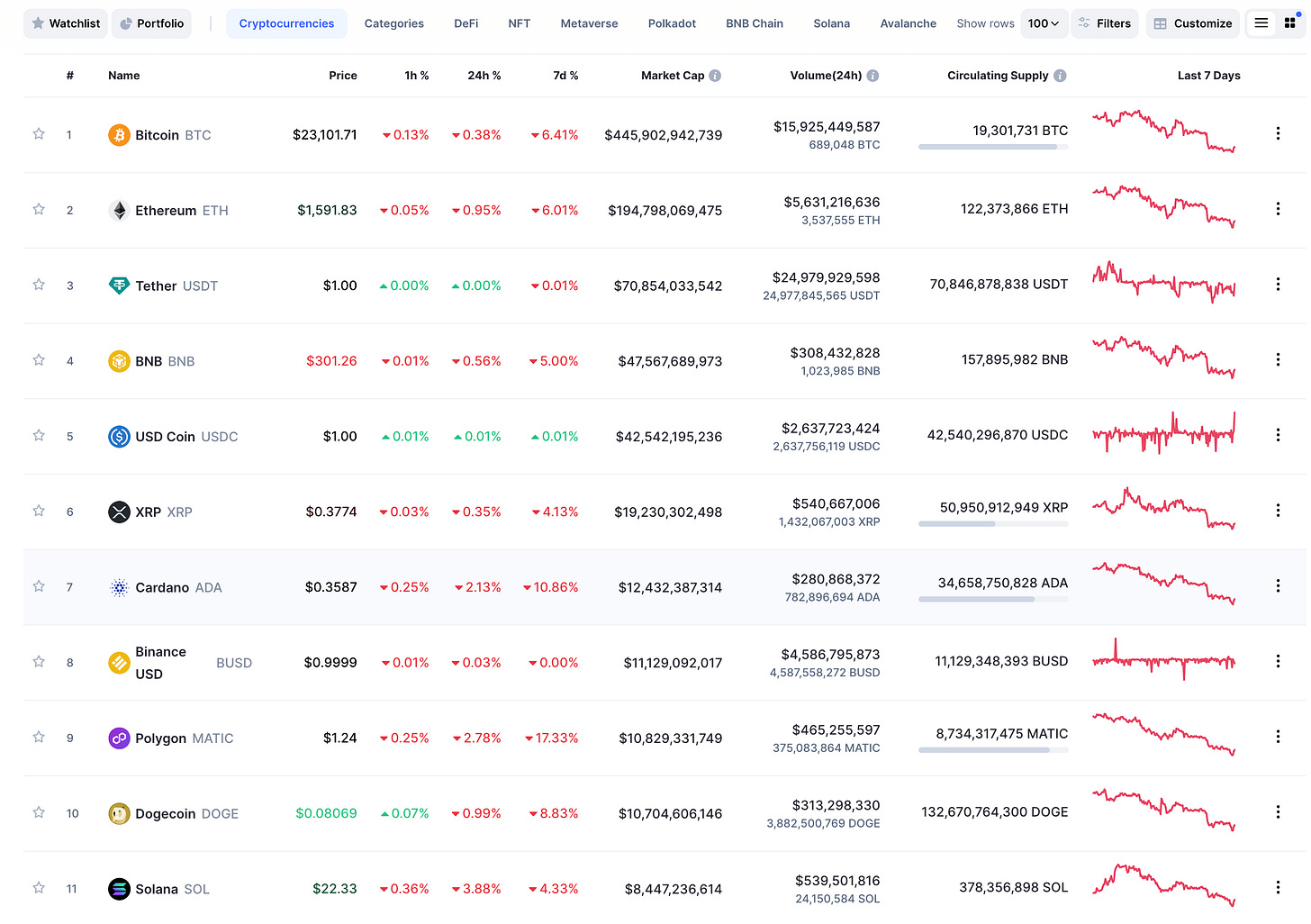

I was looking at Coinmarketcap’s top cryptocurrencies this week, and couldn’t believe Cardano was still in the top 10, ahead of Polygon, and other chains.

Nothing against Cardano - I’ve made money investing in it in the past, but that was back in 2016 when I first got into crypto. At the time, I found it promising that it was started by the co-founder of Ethereum and that they had a fancy website. But today, as a developer contributing to the crypto ecosystem, I look at things very differently, and I wouldn’t invest in Cardano anymore.

Over the years since, the market has exploded with new coins and projects, making it difficult for non-technical investors to choose where to allocate their funds. With so many options available, it's important to approach cryptocurrency investing with a strategy. This is not an article on investing nor is it financial advice, I’m just sharing some factors I consider as a developer when picking crypto projects in which to invest.

Understand the project

When investing in a token, it’s important to look beyond the hype and actually understand the project and its goals. Is it a blockchain or protocol? Does it have products or just a roadmap? Does it solve a unique problem or is it trying ride another wave and be the next ‘Ethereum killer’?

Evaluate the Ecosystems

A strong cryptocurrency project should have an ecosystem built around it. An ecosystem provides users with a complete experience and helps to ensure the longevity of the project. For a blockchain, that should include wallet providers, block explorers, marketplaces (DeFi or NFTs), a well-maintained smart contract programming language, and perhaps other dApps for DAOs or the Metaverse. So many coins are just a well-marketed promise of what could be and don’t have products that are widely used or consumed by people.

Evaluate their Integrations and Partnerships

Besides just the ecosystem around a blockchain, it’s crucial to evaluate integrations and partnerships. For example, you can now connect a crypto wallet to Instagram to display digital collectibles, yet the only blockchains and wallets supported are on Ethereum, Polygon, Flow, and Solana. Another example would be NFTs - the most infamous ones being CryptoPunks, BoredApes, and NBA TopShot, all of which are either on Ethereum or Flow. That said, there are plenty of other projects on Polygon, like the Starbucks Odyssey rewards program that is notable. But I don’t know of any on any other chain. Finally, another big integration would be with Infura. Infura is a provider that allows apps to interface with different blockchains and get data, and has integrations with Ethereum and Filecoin, and many other L1/ L2 networks, but not Cardano.

Evaluate Volume

The volume of a cryptocurrency project is an important factor to consider when evaluating its potential. Look for projects with high transaction volumes and a large user base. Additionally, evaluate the level of developer activity on the project. A strong developer community is a good sign that the project is well-supported and has a bright future.

Given all that, here are my favourite projects that I have chosen to invest in.

Ethereum - this one goes without saying. It is the most robust, widely used, and complete blockchain network today. It has the most popular developer community and most smart contracts deployed.

Polygon - Polygon interacts with Ethereum to help speed up transactions and reduce energy usage and cost, and is compatible with most of the Ethereum ecosystem, like Metamask wallet. It’s a go-to choice for many brands, like Starbucks.

Filecoin - Filecoin is a decentralized storage network that allows users to rent out their unused hard drive space and earn Filecoin tokens in return. It’s also a way for people to pay for higher uptime when loading decentralized files. It’s used a lot in the NFT sphere. While you may think the files associated with an NFT are stored on the blockchain network itself, it’s actually stored on IPFS, a decentralized file-storage network. Loading and storing files can be time-consuming though, and Filecoin provides an incentive for improved performance.

Flow - Flow is a Blockchain focused on NFTs and gaming. While it’s still in its infancy, it has an impressive lineup of wallet providers, block explorers, marketplaces, smart contract language, and developer tools.

The Graph - this is a decentralized API for indexing and querying data on the Ethereum blockchain. It competes with other blockchain data providers like Infura and Alchemy (both of which are centralized).

This is not financial advice and you should always do your own research before investing in any securities or cryptocurrencies. The trading strategies mentioned above are only my opinion. I am not a public equities analyst, and you're following these tips at your own risk.

Paradigm Shift

4-Day Work Week

By Roman Kuittinen-Dhaoui, BBA (Hons.), CPHR Candidate

Essay by ChatGPT

TLDR by Roman

The concept of a four-day workweek has gained popularity in recent years, with proponents arguing that it can lead to increased productivity, better work-life balance, and reduced stress. However, there are also potential drawbacks to implementing such a policy. In this essay, we will explore the pros and cons of a four-day workweek.

One major advantage of a four-day workweek is increased productivity. When employees have more time to rest and recharge, they may return to work with renewed energy and focus. Additionally, by reducing the number of workdays, companies may be able to incentivize employees to work more efficiently and make the most of their limited time. This could ultimately lead to a boost in productivity and profitability.

Another potential benefit of a four-day workweek is improved work-life balance. With an extra day off each week, employees may have more time to pursue hobbies, spend time with family and friends, or simply relax and recharge. This could lead to reduced stress and improved mental health, which could have a positive impact on both personal and professional life.

However, there are also potential downsides to a four-day workweek. One major concern is that it could lead to reduced income for both employees and companies. If employees are working fewer hours, they may receive less pay, which could have a negative impact on their financial stability. Additionally, if companies are not able to maintain their level of productivity with fewer workdays, they may see a decline in revenue and profitability.

Another potential drawback of a four-day workweek is that it could lead to increased workload and stress on the remaining workdays. If employees are expected to complete the same amount of work in fewer days, they may experience increased pressure and stress, which could ultimately lead to burnout and decreased productivity. Additionally, if companies do not have adequate staffing levels to cover the reduced workweek, employees may be required to take on additional responsibilities and work longer hours on the remaining days.

In conclusion, while a four-day workweek has the potential to increase productivity and improve work-life balance, it is important to carefully consider the potential drawbacks and ensure that it is implemented in a way that is fair and sustainable for both employees and companies. Companies should weigh the potential benefits and costs before making any changes to their work schedules, and work closely with employees to ensure that their concerns are addressed and their well-being is prioritized.

TLDR: I’d rather work 10-hours per day, 4 days a week, as opposed to 8-hours per day, 5 days a week

(Head)Space

By Vlad

Impostor Syndrome in Tech

It is very common for people to feel like they don’t have what it takes. Especially when working with extremely talented people, it is often easy to think that one’s qualifications and skills are “not good enough” for the responsibility they bear. But if it’s any reassurance, you should know that everyone thinks this way. If you feel this way, unless you are grossly underqualified (it would be obvious), you are most likely experiencing impostor syndrome.

Impostor syndrome is a psychological pattern where an individual doubts their skills, accomplishments, and overall value. Despite evidence to the contrary, they feel like they are "faking it" or "not good enough" for their role. It is often accompanied by fear of being exposed as a fraud.

Impostor syndrome is particularly prevalent in highly technical roles, where there is a high level of expertise and knowledge required. Individuals in these roles may feel like they are not as talented or knowledgeable as their colleagues, leading to feelings of inadequacy and self-doubt.

The truth is, most people experience impostor syndrome at some point in their career, regardless of their qualifications or level of expertise. It is a common experience, and it's important to recognize that you are not alone.

If you find yourself experiencing impostor syndrome, there are several things you can do to help alleviate these feelings. For example, you can:

Recognize your accomplishments: Make a list of your achievements and milestones in your career. This can help you recognize your skills and accomplishments and remind you of the value you bring to your role.

Talk to others: Reach out to colleagues, friends, or a mentor and share your feelings. They can provide support, advice, and encouragement.

Challenge negative thoughts: When negative thoughts arise, challenge them. Ask yourself if they are based on fact or if they are just your own self-doubt. Replace negative thoughts with positive ones.

Focus on learning: Highly technical roles require continuous learning, so focus on learning new skills and expanding your knowledge base. This can help you feel more confident in your abilities.

TLDR: Combat impostor syndrome with recognition and support.

Company of the Week

One start-up company that has gained attention in recent years is Oatly, a Swedish-based company that produces plant-based oat milk and other dairy alternatives. Oatly was founded in the 1990s, but it wasn't until the early 2010s that the company began to gain traction. Oatly has been praised for its environmentally friendly production methods, as well as its commitment to transparency and sustainability. The company has also been successful in appealing to younger consumers who are looking for more ethical and health-conscious food options. In recent years, Oatly has expanded its product line to include ice cream, yogurt, and other dairy-free alternatives, and the company has plans to continue growing its business in the coming years. With its innovative products and commitment to sustainability, Oatly has established itself as a leading player in the plant-based food market.